|

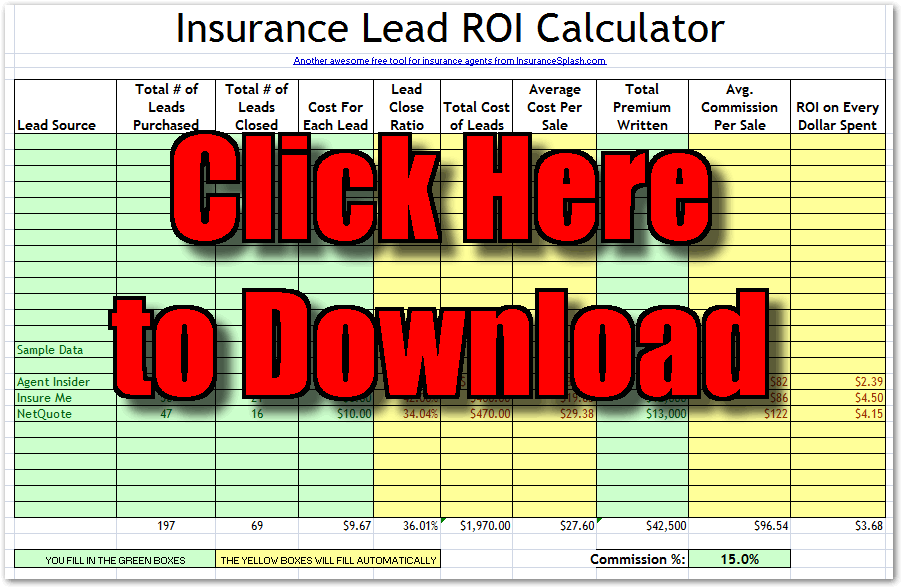

What other marketing initiatives do you have that are so easy to track the results of? What other marketing can be turned on and off based on your agency’s day to day availability? None. And if I had a dollar for every agent who approached me about cutting out the lead companies and generating their own leads online I’d be rich. But 99.9% of them will not be. What I suggest instead, is make sure you’re getting the biggest bang for every dollar you spend on leads. One of the ways to get the most for your dollar is to close more leads. I’ve put together some great resources about that here and here and here. Now I’ve created a tool to help you determine which lead providers you should be investing your dollars with. It’s called the Insurance Lead ROI Calculator and you can click here to download it right now. What is The Insurance Lead ROI Calculator?The Insurance Lead ROI Calculator is an Excel spreadsheet to track and compare the return on investment (ROI) of all the different lead sources you purchase in your agency. It is not for tracking every individual lead. It’s for comparing ROI of your different lead sources over time to determine the provider(s) that make you the most money. Why Did You Make The Insurance Lead ROI Calculator?The majority of agents I know sign up with and continue to buy from lead providers based on stuff like:

None of those factors are what you should be using (as a serious businessperson) to determine where to allocate your lead dollars! The only way to determine the best lead sources for your agency is to keep track of your actual results! But it’s a little tricky to measure. So I wanted to make it as easy as possible to you to track and act upon. Should I Use the Insurance Lead ROI Calculator Every Day?No. This is not a tool for daily use, it’s meant to be used once a month (or longer) when you have cumulative information about the results of your different lead sources. In fact, the longer period of time you track results from, the more accurate and actionable your ROI calculations will be. What Information Do I Need to Enter?For each lead provider over the period of time you’re comparing you’ll need to know:

After entering that information, the calculator will tell you each lead source’s:

What Type of Leads Should I Track?I recommend using this tool for lead situations where you purchase the contact information of a specific person who is actively shopping for insurance. What type of Leads Are NOT Optimal to Track With This Tool?I advise agents against using it to measure lead generating marketing that also has a branding effect or other residual marketing benefits. Basically, it’s so much easier to track sales from an internet lead than from direct mail that if you use this tool to compare the ROI of the two methods against each other the internet leads will have an unfair advantage. For example, if your agency did a direct mailer to 1,000 people, you can track the number of leads it generated, the sales, the cost per lead and the total premium written, but this tool wouldn’t take into account the brand awareness you created by getting your message in front of 1,000 people. With that being said however, it CAN be used effectively to compare different campaigns that are essentially the same type of marketing. For example, if you sent out 12 different mailers throughout the year, it would be a good tool to compare each of those 12 mailers against each other, because you’re comparing apples to apples. Okay, So How Does It Work?First: Download the ROI Calculator File here: Second: Only write in the GREEN boxesThe boxes that are GREEN are for you to fill in. The boxes that are YELLOW will calculate automatically. (Yes I know that is orange but yellow is hard to read and I think you get the idea) Third: Figure it outUse the sample data I put in there to get a feel for how it works. I could go on in intricate detail but I think you can probably figure it out from there. And if you have a question, just ask it in the comments below. Wrap UpIf you think this is a cool tool that you can use, make sure to hit the Like button or share it on social media so I know you want more stuff like this.

And if you have a colleague or manager that would be interested please pass it along! Hope this helps, John

2 Comments

7/3/2023 07:18:58 am

I haven't used that calculator. I think it is less hassle to use that one.

Reply

12/4/2023 11:04:08 am

When buying from fiverr for a long time, one of the things that these creators have to be able to do is basically read your mind to know what you wanna say with a thumb nail. This guy does exactly that

Reply

Leave a Reply. |

InsuranceSplashThe #1 Insurance Marketing Website for Agents. Free insurance marketing ideas, tools, strategies, and training to help agents succeed. Archives

June 2023

Categories

All

|

RSS Feed

RSS Feed