You don’t hear as much about these two things:

Here’s 34 ways to improve your insurance agency’s customer retention. No excuses, decide which retention strategies you like and take action! 1) More Customer ContactsDon’t harrass your clients, but the more times they hear from you throughout the year the less likely they’ll consider shopping around. The key to multiple touches throughout the year is to vary the method and make sure you’re always bringing value. The same email every month about why to buy life insurance doesn’t cut it. Need ideas? Here’s a few: emails, phone calls, newsletters, postcards, seminars, policy reviews, holiday cards, birthday cards, text messages, surveys, handwritten letters, webinars, community events, recommendations, gifts, billing notices, customer appreciation parties. 2) Cross Sell MoreIt’s very simple: The more lines you sell someone, the higher their retention rate. I used to work for a company that gave such a big discount on your auto insurance if you bought a renters policy it was usually cheaper to have both. A lot of agents thought the company was crazy but I didn’t. I know the retention rate for those clients went through the roof when we added that extra policy. 3) Annual Coverage Reviews

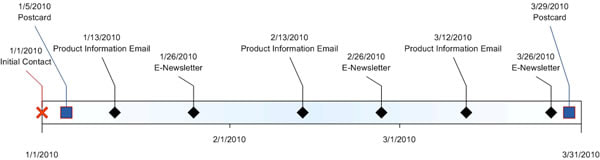

Remember that even when clients decline your offer to review coverage, they’ll still appreciate the gesture and won’t be able to use, “I never hear from my agent.” as an excuse to shop around. 4) Discount ReviewsHas a client ever left you to save 10% when you could have saved them 15% just by applying all the discounts they were entitled to? Don’t lie. It’s incredibly frustrating and I know a lot of agents that will blame the client for not calling you first. This is wrong. Asking your clients a few questions every year to make sure they have every discount they’re entitled to will make them feel more confident they’re getting a fair price and they’ll be more endeared to your commitment to saving them money. 5) Strengthen Your “Onboarding” ProcessMarriage is the most important and longest lasting commitment most people ever make and that’s why every culture makes such a big deal out of wedding ceremonies. I know it sounds silly, but I encouarage agents to compare their new client onboarding processes to a wedding ceremony. Do your new clients feel like they’ve just joined a family, or made a business transaction? Unless Kim Kardashian is your client, the more your onboarding process resembles a wedding the longer they’ll stick with you. By the way, this is a highly symbolic analogy so don’t toss rice or tie cans to their car. 6) Call Before Premium IncreasesI know many agents prefer to “let the sleeping dog lie”, but when you know a client is going to receive a big premium increase I recommend being proactive about it. If you’re open and honest, the good clients will appreciate it. You can also give people an opportunity to change coverages around or identify any additional discounts to reduce the effect. Orient your conversation around what is causing the increase and what can be done to offset it if needed. Assume that leaving your agency is not an option. 7) Setup Automatic PaymentsClients on EFT payments renew their policies at a much higher rate than those who write a check and mail it every month. It’s just too convenient to stay and too inconvenient to leave. Getting your clients on automatic payments is a mini-sale within the sale and should be appreciated for its value. Make sure your staff is aware how important it is and compensate them accordingly. 8) Get More ReferralsEvery agent loves referrals and you can never have too many, but one value that often goes unappreciated is that clients who refer are more likely to renew. It’s psychology… if I tell everyone you’re the best agent ever,

9) Shop Rates For ThemObviously it won’t work for the captive agents but for the independent guys, sending your client comparison quotes with your other carriers once a year is a great way to keep them with your agency. It doesn’t matter if you send quotes for the worst carriers, just seeing a few other numbers that are higher than what they’re paying is all most people need to stay put. 10) Pre-renewal Phone CallsSimple idea: call your clients before the renewal to thank them for their continued loyalty and offer to answer any questions they may have. If reaching out to your entire book sounds daunting, identify the most important clients and reach out to them. Or identify the “flight risks” and call them. 11) Pre-renewal Holiday CardsThis is a little twist for agents who send out Christmas cards. Send clients a holiday card in the month before their renewal arrives. Each month you’ll have a new card for the holiday but it only goes out to your clients renewing the following month. In February you send Valentines to the clients renewing in March and in March you send St. Patrick’s day cards to the clients renewing in April. (and so on) It’d be about the same cost as Christmas cards, but more timely and more noticeable. 12) Remind Clients of Longevity BenefitsI used to be a claim adjuster and can honestly say that when a question arises about paying a claim, one of the first things looked at is the client’s longevity with the company. A straightforward claim will not be affected but if it could go either way (and claims often can) a 10 year client will get coverage at times that a first year client will not. Don’t be afraid to remind your clients this. It’s true. 13) Educate Your ClientsThe more your clients understand insurance, the more value they’ll see in your services. On the other hand, when clients only understand price you’re 100% dispensable. If you truly understand and believe that clients should stay with you regardless of price it’s your job to educate your clients as to why. If you can’t do that, maybe you don’t really know the answer yourself. 14) Random Acts of KindnessThere’s a term in psychology called reciprocal altruism that says, “do something nice for someone, and there’s a better chance they’ll do something nice for you” (like renew their policy). Sending clients an occasional handwritten note or personal email, giving their children balloons when they come into the office, or mentioning a client’s business on your Facebook page are just a few ideas. The hand that gives, gathers. 15) Remember Clients’ ChildrenIt probably sounds silly, but when people I do business with remember my childrens’ names and ask about them, I feel very respected and greatly appreciated. If my insurance agent asked about my kids every time I saw him I would never leave. This might be good information you can keep track of in your CRM. You can pretty much always ask “How’s the family?” and manage your way through the conversation appearing to know a lot more than you do. 16) Anniversary PresentEarlier in this article, I likened the on-boarding process for new clients to that of a wedding ceremony. If you really want to take this analogy further send your clients an anniversary gift each year. If you follow this schedule you won’t need to buy a diamond for 60 years. You could also just send a “virtual” anniversary gift. Email a picture of a gift and explain you’d like to buy it for them, if only the insurance regulators would allow it. ;) 17) Reward for RenewalsI’m sure there are others, but I know Allstate, Nationwide, and United Healthcare offer some sort of deductible reduction for each continued year of insurance. As an insurance agent you can’t change the policy offerings but perhaps there are certain benefits you can offer your longtime clients so they feel more appreciated and like they’d be giving up an earned benefit by leaving. I’m sure you can come up with better perks, but here’s a few to get you thinking. Give your longtime clients a special phone number, an appreciation party, access to your top customer service representative, a special customer service email address, or a special discount card that saves them money at other local businesses. 18) Birthday Cards or LettersFace it, everybody likes getting birthday cards. It doesn’t matter who it’s from or how old you are, just knowing someone remembered and made the effort makes you feel good. If you’re worried about the cost, time involved, or distraction, consider sending birthday cards to your top 10% of clients. 19) Exaggerate Your Sales SuccessYour current clients want to see that you’re selling a lot of insurance. When they think people are lining up to buy insurance from you every day of the week it proves that they still have a good price with a good company. When you say things like, “we’re having a slow month,” your clients will hear, “No one wants to buy the product you’re currently paying for… time to shop around.” 20) Make Them LaughI guess this is more of a just a general customer service/experience tip, but every laugh you get from a client makes them a bit more of your friend and a bit less of your client. When your clients are your friends they’re a lot more forgiving when the policy goes up at the next renewal. 21) Follow up with ClaimsCustomers who have had a claim in the last policy period are one of the most likely segments of your client base to non-renew. Why? Because claims suck. I was a claim adjuster long ago and I know there are many great claim experiences but a very high percentage of them are very unpleasant. But here’s the good news: As an agent, you can play an integral role in your clients’ claim experiences. In order to do so, you need to establish a procedure to contact customers with claims and follow up regularly until the claim is complete. When clients have a bad claims experience and they don’t tell you about it, they’ll think the only way to send a message to the company is by cancelling the policy. Take the complaint, absorb it, apologize, and keep the client. 22) Attract Better ClientsOkay, I know that everyone would like better clients. Most agents are more than willing to take anyone with a heartbeat and I understand. I guess my point is this, when you’re trying to determine where to spend your marketing dollars, keep in mind the lifetime value of each sale. It may cost half as much to get clients from the wrong side of town, but if they leave your agency 3 times as often spend your marketing dollars elsewhere. 23) Remind Clients About DiscountsInsurance shoppers love discounts. And they hate not getting discounts. When you remind your clients about every discount they get during every interaction, it does two things that help retention:

Prospect: “Do you offer a discount for X?” Agent: “Unfortunately no, but I’m confident we can save you money even without that discount.” Prospect: “Well, I can’t get past the fact that they reward me for X and you guys don’t even care.” Wouldn’t you like your competitors to have that conversation if your clients ever call them? 24) Build Social Network ConnectionsI mentioned how important it is to “touch” your clients as frequently as possible. Connecting through social networks makes this even easier. Each time you connect with a client virtually they’re making a bit more of a commitment toward you. When clients connect with you, it’s like combining the recommendation benefit from #8 with the connection benefit in #7 and the increased number of contacts benefit of #1! 25) Take Ownership of ProblemsBecause we often want to make ourselves look better, when things go wrong with a customer it’s only natural to blame the problem on factors out of our control. While this is the intuitive approach, it is not best for business. When your client has a complaint and you blame forces outside your control they have no reason to stay with you. The problem is likely to reoccur. Blame yourself and explain why it won’t happen again and you’re far more likely to retain that upset customer. 26) New Client Follow-Up ScheduleClients who have been with you for less than 2 years are the most likely to non-renew. Develop a procedure for keeping in regular contact with them by phone, email, or snail mail. It should be “contact-heavy” at the beginning and can ease off over time but should ramp up again during renewals and any other important times in the life of the policy. For the first couple years, make sure your clients don’t get any surprises. When their policy, declarations page, renewal, and any other paperwork comes in the mail they’ll be expecting it and already know what to do with it because you called them first. 27) Make Someone Responsible for RetentionWhen everyone is equally responsible for retention, no one is. Put someone in charge of developing strategies to increase retention (they can probably just read this article) and pay them for delivering results. Also, your other staff members may be more likely to support the goals of agency retention when it’s not being driven by the person who has the most to gain. (You) 28) Pay Staff on RetentionIf you’re not paying your staff for customer retention, why should they care? I believe one person should hold the lion’s share of the responsibility and the potential commissions for retention success but anyone else who can play a role in helping or hurting retention should have some skin in the game. Your non-commissioned CSRs might be more important with retention that your producers. 29) Customer SurveysWhen you ask clients for feedback about your agency it accomplishes a lot of things:

30) Don’t Burn BridgesThis isn’t really a retention strategy as much as a re-acquisition strategy but I thought it belonged here somewhere. When someone leaves your agency and there’s nothing you can do to retain them, make sure it’s as pleasant an experience as possible for them. In this business, the grass is often not as green as it looks over there and many customers will come back if you let them leave with appreciation and respect. 31) Improve Your Customer Service

32) Give Referrals to Your ClientsIf you’re a regular source of referrals for clients that own small businesses or work in sales, they’ll never leave you. When you can control connections of people within your community you’re offering an amazingly valuable service on top of insurance advice. Make sure you get credit for every referral you give and consider making a table or bulletin board in your office somewhere for client promotional materials. Just thinking they might get yanked off your “Wall of Recommended Businesses” could be enough to keep many people from leaving. 33) Promote Your Most Loyal Customers.Social proof is a sales tool that involves showing prospects other customers who bought from you and are happy. Video testimonials can be a great for new sales but they can also be used as a retention tool. For example, get a video testimonial from one of your most loyal customers and find ways to show it to your current customers. Post it to Facebook, email it to your “flight risk” clients, play it on a monitor in your waiting room, etc. 34) Don’t Sell Only on PriceIt’s tempting to sell on price, especially when you’ve got the lowest one. Selling on price may work today but it kills retention. If you can save a prospect money and you have the cheapest rate, move on to all the other benefits of your agency. They won’t forget the savings, I promise. In the insurance business, no honest company can have the cheapest rates forever. Here’s What To Do NextFirst - Click the Like button on this page so I know you want more content like this.

Second - Share a link to this article with an agent or sales manager you trust and discuss the ideas that will work best for you. Third - Develop a plan of attack for boosting retention and take action by the beginning of next week. Retention is necessary to build and maintain a successful insurance agency.

9 Comments

6/23/2023 05:13:09 am

Those strategies are great. Hope they are effective.

Reply

12/6/2023 04:53:05 am

This blog offers practical insights into enhancing customer retention for insurance agencies. The strategies presented are not only effective but also adaptable, catering to the evolving needs of clients. The comments section becomes a dynamic forum, with professionals exchanging additional strategies and success stories.

Reply

3/2/2024 03:49:35 pm

Stellar. Keep up the amazing work. Discover the beauty of interior doors for your home.

Reply

3/4/2024 10:54:51 am

Many thanks for the enriching content! Discover plumbing contractor on our website.

Reply

3/7/2024 07:37:49 am

Absolutely stunning! Your creativity knows no bounds. Ready to elevate your space with expert drywall installation? Visit our website for premium services.

Reply

3/7/2024 08:11:41 am

Fabulous! Keep shining your light! Looking for a painting company Utah? Brigham Painting & Drywall is at your service!

Reply

4/29/2024 12:16:27 am

Your enthusiasm for this topic is evident in your writing. It's infectious!

Reply

4/30/2024 04:35:01 am

Kudos on another well-researched post!

Reply

Leave a Reply. |

InsuranceSplashThe #1 Insurance Marketing Website for Agents. Free insurance marketing ideas, tools, strategies, and training to help agents succeed. Archives

June 2023

Categories

All

|

RSS Feed

RSS Feed